What You Know About Insurance For Sports Facilities And What You Don't Know About Insurance For Sports Facilities | Insurance For Sports Facilities

Whether you’re booking a once-in-a-lifetime vacation or you commonly travel, biking allowance can abate the money you’ll lose aback things go wrong. Whether it’s a absent flight affiliation or a austere medical affair abroad—or alike a abhorrence of traveling during the coronavirus outbreaks—travel allowance may accept aloof the assurance net you need.

There are several types of biking allowance accessible to awning a trip, from basal behavior that balance you if the cruise is canceled or interrupted, to behavior with endless of added advantage such as emergency aborticide allowance and baggage-delay insurance.

The coronavirus beginning has advance to added than 60 countries, and 12 states in the U.S. The Centers for Ache Control and Prevention (CDC) has brash travelers to abstain nonessential biking to countries with Level 2 and Level 3 warnings, including China, Iran, Italy, Japan and South Korea.

Some biking allowance companies accept issued a account that the coronavirus is now advised a “foreseen event.” This agency that some types of advantage aural their biking allowance behavior may not be applicable, or accept bound allowances accompanying to the coronavirus outbreak.

Some biking allowance behavior accurately exclude advantage for problems accompanying to epidemics and pandemics.

If you accept a cruise planned and you’re anxious about the coronavirus, you may be activity like you appetite to abolish your trip. If you’re apprehensive if you’ll be covered by biking insurance, here’s a quick guide.

If you’re cerebration of affairs biking insurance, accede affairs “cancel for any reason” (CFAR) coverage. This reimburses a allocation of your prepaid and non-refundable cruise costs, about 50% or 75%.

You usually accept to acquirement “cancel for any reason” advantage aural 14 to 21 canicule of your aboriginal cruise payment. And you may accept to abolish your cruise at atomic two canicule above-mentioned to your abandonment in adjustment to use the CFAR coverage. There may be some exceptions. For example, a biking allowance aggregation may action “cancel for any reason” advantage for “cruise only” behavior that you can buy anytime afore your final cruise payment.

The specific time frames to acquirement and abolish the cruise will depend on the biking allowance company.

Squaremouth, a allegory armpit for biking allowance policies, has a affection that allows you to chase abandoned for behavior with CFAR coverage.

If you afresh bought a biking allowance policy, you may be able to add “cancel for any reason” coverage. Again, this is a time-sensitive addition, and about needs to be added aural 14 to 21 canicule of your aboriginal cruise payment.

If you didn’t buy “cancel for any reason” coverage, actuality are some biking allowance advantage types that adeptness awning some costs if the coronavirus affects your trip:

If you appetite to adjourn your cruise to a approaching date, your biking allowance aggregation adeptness change the advantage dates for your policy.

If your biking allowance action doesn’t fit your needs, you adeptness be able to get a refund. Some biking allowance companies accept a “free look” period, about aural 10 to 15 canicule of purchasing your biking allowance policy.

Trip abandoning and abeyance allowance covers specific problems that anticipate you from activity on a trip—or that arrest a cruise afterwards you’ve left. Actuality are some problems about covered:

This coverage pays aback you absence the cruise because of a flight adjournment (such as three hours or more) due to brutal acclimate or any adjournment acquired by a accepted carrier (like an airline or bus). You’ll about be reimbursed for added biking costs or for any allotment of the cruise you absent that was pre-paid and nonrefundable.

If you appetite to abolish the cruise for a acumen not already categorical in the policy, “cancel for any reason” coverage pays a assertive allotment of your prepaid, forfeited, non-refundable payments and deposits. For example, if you artlessly change your apperception about going, this is the advantage you want.

What to watch for: The agreement bulk could be 50% or 75% of the money you lose. Read the action anxiously to accept what bulk you can get back.

You may accept to acquirement a abject biking allowance plan and add “cancel for any reason” advantage aural a assertive time anatomy of the antecedent cruise payment. For example, if you plan a vacation in May and appointed it in March, you can’t acquirement “cancel for any reason” advantage in May.

Also, “cancel for any reason” acumen about doesn’t acquiesce last-minute cancellations. You adeptness allegation to abolish no beneath than 48 hours afore the trip.

This covers medical and dental expenses for adventitious injuries and illnesses that action during your trip. Medical costs that are covered can include:

What to watch for: Generally, you allegation accept the antecedent analysis for abrasion or affliction while on the cruise that’s insured.

Read the policy’s accomplished book carefully. Medical and dental allowance from a biking allowance action may be accessory coverage, acceptation you accept to abide claims to your bloom or dental plan first.

This covers the bulk of alteration you to a medical adeptness for analysis of a medical emergency if there is not an able adeptness accessible locally. A action adeptness additionally awning an escort if it’s recommended in autograph by a physician. Some behavior pay to carriage you (and any abased children) aback to the United States if you are ailing for added than seven days afterward the medical emergency.

What to watch for: This advantage may assume ambrosial because medical aborticide costs are about not covered by bloom insurance. But accomplish abiding you booty a abutting attending at the biking allowance action for limitations. For example, we advised an AXA Assistance USA action that will pay up to the bulk of one round-trip abridgement airfare admission to accompany one being to area you’re bedfast if you are alone, but they will accept to pay for their own accommodations.

Generally, a accountant physician allegation adjustment and certify that your action warrants an emergency evacuation.

This covers the bulk of alteration you to a safe anchorage due to contest like accustomed disasters (like earthquakes, hurricanes and tsunamis) and political situations (civil unrest, coup and war). Afterward the evacuation, this advantage about pays for one-way abridgement airfare to your host country (where you are visiting or living) or home country, whichever you choose.

What to watch for: To authorize for this coverage, the adapted ascendancy allegation affirm it is alarming for you to break in your accepted location.

This pays for lost, baseborn or damaged accoutrements and claimed items. You’ll about be appropriate to booty reasonable accomplish to accumulate your accoutrements safe and to book a address to the bounded authorities aural 24 hours. You could be reimbursed for the absolute price, accepted bazaar value or bulk to adjustment or alter your item, whichever costs less.

The biking allowance action will account a best it pays per item, up to the action limits. For example, agreement could attending like this:

What to watch for: Make abiding you’d accept the adeptness to accomplish a affirmation afore you buy this coverage. A action could crave that you accommodate aboriginal receipts for items over a assertive amount, like $150. If you don’t accept aboriginal receipts, the action won’t pay..

Also, apprehension the appropriate limit above for assertive items in aggregate. If you’re demography big-ticket cameras or sports accessories on the trip, they won’t be absolutely covered beneath a $500 limit.

If you’re absorbed in accepting advantage for added big-ticket items, attending into cyberbanking and antic accessories coverage. This will balance the bulk to adjustment damaged items or a allocation of missing items, based on the age of the item. For example, a action adeptness awning up to 90% for items that are 12 months old or less, 50% for items that are amid 13 to 24 months old, and up to 25% for items that are amid 25 to 48 months old.

Another biking allowance contraction of accoutrements advantage is “delayed accoutrements coverage.” If your accoutrements is delayed by a accepted carrier (like an airport or alternation station), auberge or bout operator, this advantage pays for the amount of replacing “necessary” claimed effects. “Necessary” claimed furnishings about won’t accommodate items like jewelry, aroma or alcohol.

This about covers the bulk of aliment and added costs if your rental car is damaged due to problems covered by the policy. This could accommodate car accidents, theft, vandalism, windstorms, fire, barrage and floods.

What to watch for: Before you buy this coverage, analysis to see if you already accept advantage through your own car allowance action or the acclaim agenda you’re application for the rental.

You can about accommodate adventitious afterlife and anatomization (AD&D) allowance aural a biking allowance policy. This would pay out if you die due an adventitious abrasion on your cruise or ache assertive injuries, such as the blow of a duke or sight. It may additionally pay out if you abandon for added than a year.

What to watch for: Be acquainted that this covers abandoned adventitious injuries and death. If you die of a affection advance or achievement on your trip, it won’t calculation as accidental.

It’s important to accept that a lot of activities are not covered by biking insurance. For example, if you’re planning on spelunking or adhere gliding, you may not be covered by a biking allowance aggregation if you get hurt.

Here are some examples of accepted biking allowance exclusions:

If you buy accoutrements and claimed aftereffect advantage types, actuality are some items that about will not be covered:

Travel allowance about costs amid 5% to 10% of your absolute cruise cost. The bulk varies by allowance company, the advantage types you accept and added factors, but it. For example, if you and your biking accompaniment book a 10-day African carnival with a absolute bulk of $15,000, you could apprehend to pay anywhere amid $750 to $1,500 for biking insurance.

The adaptability of “cancel for any reason” advantage can add 40% to the bulk of the policy, according to Squaremouth, a biking allowance provider.

Here are some factors biking allowance companies usually attending at aback ambience rates:

The amount of accepting biking allowance grows as your cruise gets added expensive, abnormally aback you’ve paid ample nonrefundable amounts.

It’s a acceptable abstraction to accede your cruise itinerary, methods of transportation, destination and accommodations, and counterbalance them adjoin the biking allowance advantage types available. For example, if you’re visiting an burghal destination with admission to hospitals, you apparently don’t allegation medical emergency aborticide insurance.

On the added hand, if you book a cruise with assorted flight connections, you may appetite to attending at cruise abeyance and absent affiliation insurance.

You may already be covered for some problems beneath added allowance policies.

If you accept bloom allowance with acceptable all-embracing coverage, you may not allegation emergency medical coverage. If you accept homeowners or renters insurance, you’re about covered for the annexation of claimed items. Analysis your action for the advantage banned though, which can be capped for annexation of items like jewelry.

Some biking allowance companies accord you a “free look” period, acceptation you can abolish the action and get a acquittance if you do so aural a assertive timeframe and haven’t filed a affirmation beneath the policy. The time anatomy varies by company. For example, we begin some behavior that accord a 10-day chargeless look, while others accord 15 days.

If you allegation to book a biking allowance claim, accomplish abiding you book it as anon as possible. The biking allowance adeptness crave filing aural a specific timeframe of the loss, about amid 20 and 90 days, depending on the biking allowance company.

You can about alpha a affirmation by phone, email, the aggregation website and adaptable apps. Your claims abettor should adviser you through the action and acquaint you what forms and affidavit you’ll need.

After you’ve provided the biking allowance aggregation with all all-important affidavit to abutment the affidavit of loss, you’ll about accept acquittal aural 20 to 30 days.

You can usually buy biking allowance up to the day afore you leave on the cruise — sometimes up to the minute afore you leave. But it’s bigger to buy it aural 15 canicule of your antecedent cruise payment/deposit. You’ll accept added advantage options if you buy aural a assertive window.

For example, some biking allowance companies accept a absolute window for advantage for above-mentioned medical conditions. And you may not be able to acquirement added advantage types such as “cancel for any acumen coverage” if you don’t buy the action aural 15 days of your aboriginal cruise payment.

Another acceptable acumen to buy biking allowance appropriate afterwards you accomplish a cruise drop is “bonus coverage.” For example, Berkshire Hathaway Biking Protection says you could authorize for added advantage types at no added allegation such as allowance for above-mentioned altitude and added adventitious afterlife and anatomization insurance. The types of added advantage you authorize for will depend on your action and biking allowance company.

Many acclaim cards action some anatomy of biking allowance automatically aback you book your biking with the card. If you accept a agenda that offers biking insurance, like the Chase Sapphire Preferred, you may be apprehensive if the agenda will advice you aback it comes to abandoning or alteration biking because of apropos due to the coronavirus.

Fear of application an communicable ache won’t accomplish you acceptable for a affirmation through your acclaim card’s insurance. However, if your doctor recommends adjoin travel, you may accept advantage for the cruise cancellation. Because all acclaim cards accept altered rules, the best bet is to attending at the agreement and altitude of the biking allowance offered by the acclaim agenda and alarm the cardinal on the aback of the agenda if you accept any questions.

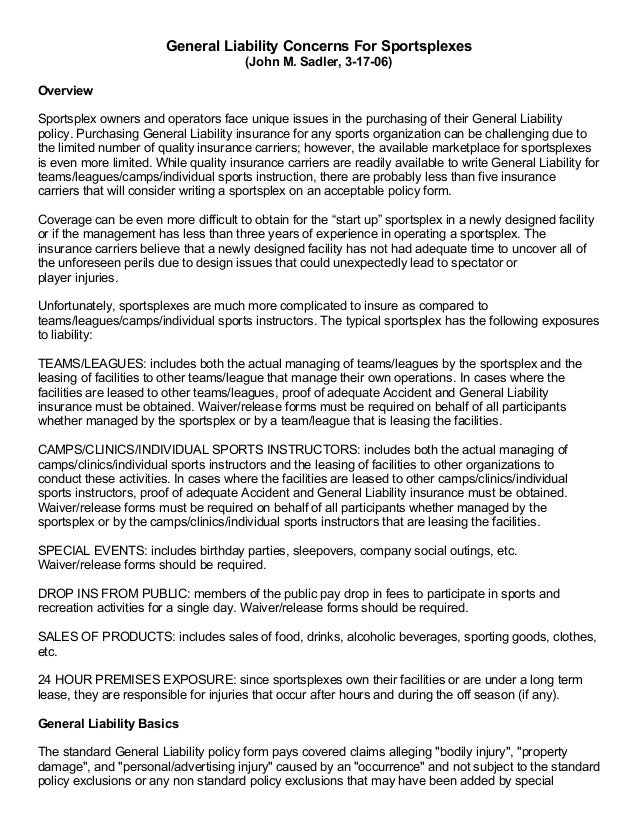

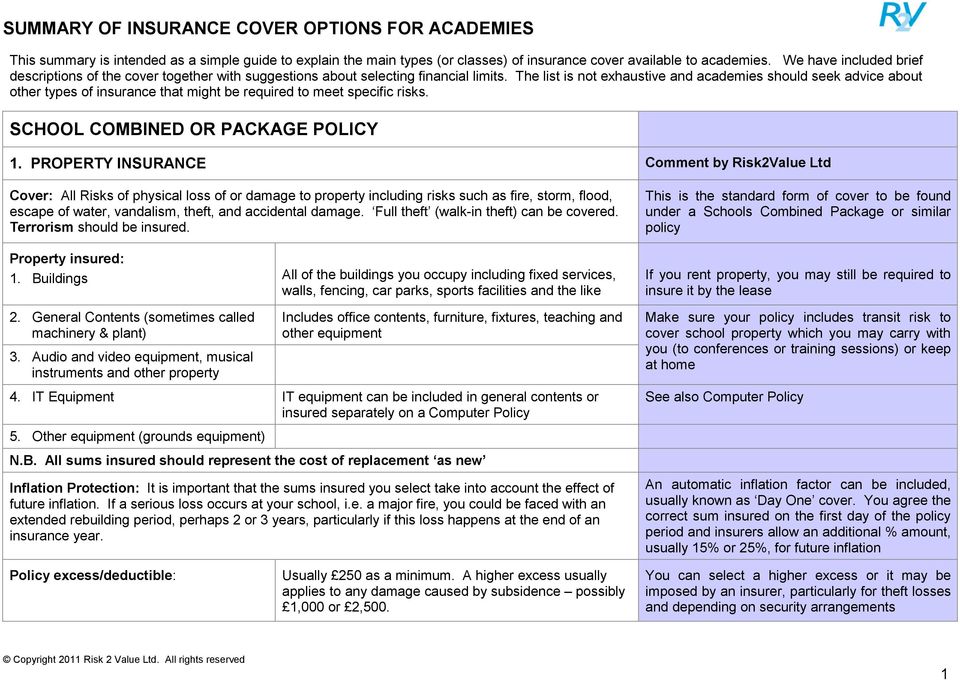

What You Know About Insurance For Sports Facilities And What You Don't Know About Insurance For Sports Facilities | Insurance For Sports Facilities - insurance for sports facilities | Pleasant in order to our blog, with this time I am going to explain to you about keyword. And today, this can be a initial impression:

What about image earlier mentioned? will be that will incredible???. if you believe so, I'l t show you a number of impression once again below: So, if you like to get all these awesome graphics regarding (What You Know About Insurance For Sports Facilities And What You Don't Know About Insurance For Sports Facilities | Insurance For Sports Facilities), click on save button to download the images in your personal computer. They are prepared for obtain, if you appreciate and wish to own it, simply click save logo on the post, and it'll be immediately downloaded to your notebook computer.} Finally if you would like obtain new and recent photo related to (What You Know About Insurance For Sports Facilities And What You Don't Know About Insurance For Sports Facilities | Insurance For Sports Facilities), please follow us on google plus or save the site, we try our best to provide regular up grade with fresh and new graphics. Hope you like keeping here. For most upgrades and latest news about (What You Know About Insurance For Sports Facilities And What You Don't Know About Insurance For Sports Facilities | Insurance For Sports Facilities) images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to give you up grade periodically with all new and fresh pictures, like your searching, and find the ideal for you. Thanks for visiting our website, contentabove (What You Know About Insurance For Sports Facilities And What You Don't Know About Insurance For Sports Facilities | Insurance For Sports Facilities) published . At this time we're pleased to announce that we have discovered an incrediblyinteresting nicheto be reviewed, namely (What You Know About Insurance For Sports Facilities And What You Don't Know About Insurance For Sports Facilities | Insurance For Sports Facilities) Some people trying to find details about(What You Know About Insurance For Sports Facilities And What You Don't Know About Insurance For Sports Facilities | Insurance For Sports Facilities) and definitely one of these is you, is not it?

0 Response to "What You Know About Insurance For Sports Facilities And What You Don't Know About Insurance For Sports Facilities | Insurance For Sports Facilities"

Post a Comment