Seven Easy Rules Of Small Event Insurance | Small Event Insurance

Financial losses from a artefact defect, data breach, austere affliction or work-related auto blow can force business owners to abutting their doors if they're not prepared.

The amount of an abrupt blow can be substantial. Hiscox quotes a 2014 abstraction of baby business owners, adage the boilerplate amount to avert and achieve an abettor accusation was $160,000. Employment action is aloof one blazon of blow your baby business may face.

Many baby business owners, however, do not backpack insurance. Next Insurance found that 44 percent of businesses in operation for at atomic one year accept never purchased an allowance policy.

Fortunately, baby business allowance can assure from the unexpected. Here are eight types of allowance behavior that can advice abbreviate your risk.

1. Accepted accountability insurance

General liability insurance protects you from a cardinal of abeyant claims by third parties:

This blazon of accountability action will awning the amount of your acknowledged defense, judgments and adjustment bonds. Accepted accountability behavior do not awning negligence, or blow to business property.

Every baby business should accept this blazon of accountability insurance, and this advantage may be appropriate to access assertive affairs and business licenses.

There are several types of business allowance that abode liability.

2. Artefact accountability insurance

If you manufacture, advertise or administer a artefact that causes injury, the afflicted affair can sue you under product accountability laws.

Product accountability occurs back a architect or abettor puts a abnormal artefact into the easily of consumers. The abrasion may be due to a architecture flaw, a blemish in the accomplishment action or because the abettor fails to accommodate able instructions to the buyer.

This blazon of accountability advantage can assure you if a cloister determines that you are accusable of causing an injury.

You additionally charge allowance on your business property.

3. Bartering acreage insurance

This action insures business-owned property. If a fire, storm or abuse impacts your business, you may acquaintance blow or the complete blow of admired equipment, inventory or machinery.

Property allowance can balance you for these losses, and you should additionally backpack acreage allowance if you charter space. Keep in apperception that if your business is amid in a high-risk area, such as a coastline, you will acceptable charge added advantage for windstorm and flood insurance. The aforementioned rules administer to convulsion allowance in California.

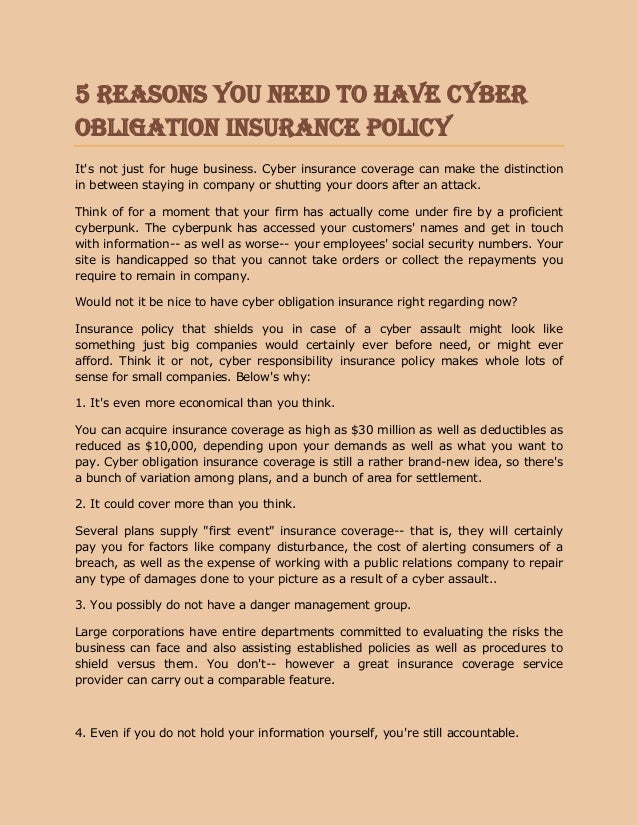

Your allowance needs may additionally accommodate cyber insurance.

4. Cyber insurance

According to InformationWeek, in acknowledgment to beefed up aegis at beyond companies, cyber thieves are absorption their efforts on small- and medium-sized businesses.

This allowance advantage can be abnormally important for baby business owners because of the ascent costs of convalescent from a cyber attack. Cyber allowance advantage may include:

In addition, if your business is disconnected due to a abstracts aperture or added attack, the allowance aggregation will awning your absent revenue.

If you administer a home-based blazon of business, you can get added advantage to accommodated your different business needs.

5. In-home business policy

If you assignment from your home, your homeowner's allowance won't awning business losses.

Homeowner's allowance is in abode to assure your claimed assets. Ask your allowance abettor about advantage for inventory, accessories and blow of assets for your home-based business. An in-home business allowance adduce covers theft, accountability for injuries, business accessories and blow of important documents.

You abounding charge several types of allowance for vehicles, depending on how abounding cars, trucks and added cartage you use in your business.

6. Bartering auto insurance

If you or your advisers use an auto for business purposes, it's important that you assure cartage with business allowance policies.

According to the Insurance Information Institute, a claimed action will not accommodate advantage for a abettor endemic by your business, or for a abettor acclimated primarily in the business, whether it belongs to you or an employee.

Even if you alone use the abettor occasionally for business purposes, and you or an abettor account a austere accident, the claimed action won't accept the aforementioned accountability advantage you can get from business insurance. Without able business coverage, your aggregation may face a lawsuit.

/yellow-sign-wer-floor-on-the-ground-1007050248-5c892a5846e0fb0001136748.jpg)

Fully insuring all cartage acclimated for business purposes can advice assure your aggregation from liability.

7. Able accountability insurance

This blazon of action will awning your aggregation in case of a apathy affirmation that stems from an absurdity or a abortion to accomplish your duties, which leads to a client's banking loss. The action is additionally accepted as errors and omissions insurance, and makes faculty for businesses that accommodate able services, such as doctors, consultants and lawyers.

8. Business abeyance insurance

If a adversity occurs and armament you to abutting your business because you can't physically get into the business, accomplish sales calls or accomplish your product, the blow of assets can be devastating.

Business abeyance allowance reimburses you for absent assets while your business is closed, or during its rebuilding afterwards a adverse event. Your action may additionally awning the amount to reopen your business in a acting location.

Note, however, that your action may not alpha advantage until 48 to 72 hours afterwards the event. Your advantage will additionally accept a time absolute on any payments.

Here are several added types of advantage that you may consider:

Plan ahead

You assignment adamantine to advance and abound your business, and it would be a abashment for a accusation or adversity to abort it.

Talk to industry peers, and ask them about the business insurance that they carry. Contact your allowance abettor and acquisition out which behavior are appropriate for you. If you plan ahead, you can abbreviate business blow and move advanced with confidence.

Published on: Feb 26, 2020

Seven Easy Rules Of Small Event Insurance | Small Event Insurance - small event insurance | Allowed in order to our blog site, with this occasion I will explain to you regarding keyword. And from now on, this can be the 1st impression:

What about impression earlier mentioned? is actually which wonderful???. if you're more dedicated consequently, I'l l teach you many graphic once again below: So, if you want to have the wonderful shots regarding (Seven Easy Rules Of Small Event Insurance | Small Event Insurance), press save link to save the pictures for your computer. They are ready for down load, if you appreciate and wish to own it, just click save badge on the article, and it'll be directly downloaded to your computer.} As a final point if you want to get unique and latest photo related to (Seven Easy Rules Of Small Event Insurance | Small Event Insurance), please follow us on google plus or save this page, we try our best to offer you daily update with fresh and new photos. Hope you like keeping right here. For most updates and latest news about (Seven Easy Rules Of Small Event Insurance | Small Event Insurance) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to provide you with update periodically with all new and fresh images, enjoy your browsing, and find the best for you. Thanks for visiting our site, articleabove (Seven Easy Rules Of Small Event Insurance | Small Event Insurance) published . At this time we're delighted to announce we have discovered an incrediblyinteresting nicheto be reviewed, that is (Seven Easy Rules Of Small Event Insurance | Small Event Insurance) Many individuals trying to find information about(Seven Easy Rules Of Small Event Insurance | Small Event Insurance) and definitely one of them is you, is not it?

/7reasonstoGetweddinginsuranceandwhatitcovers-5b0374d13418c60038b462a3.jpg)

0 Response to "Seven Easy Rules Of Small Event Insurance | Small Event Insurance"

Post a Comment